Nearly a dozen people have applied for the open tax collector position in Baden and borough council hopes to begin interviewing next week.

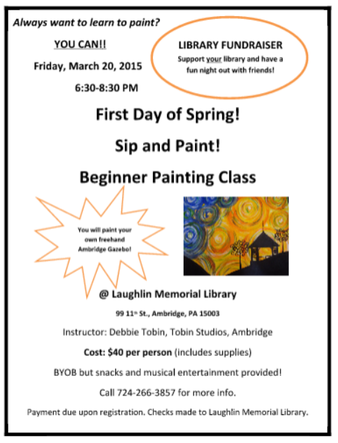

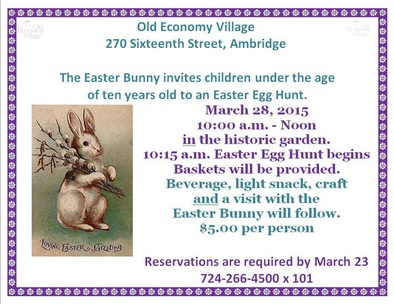

advertisement

advertisement Her husband, Keith Kristek, is currently under investigation due to a large amount of money missing. The Beaver County District Attorney’s office is looking into the financial records at the tax collector’s office.

Council will recess the regular meeting on Wednesday to allow time for interviews before reconvening to hire someone by April 1. Stuban said school officials will be invited to join the interviews and provide input.

The borough has until April 4 to fill the position before any candidate can petition the courts.

Stuban said many of the people who have applied have had questions about the pay and what's involved because they don’t quite know what is expected of them.

He said the borough should provide a job description, and also suggested asking a neighboring community tax collector to provide the appointed person guidance and a few hours of training. The appointed candidate will have to be properly bonded for about $3-$4 million, the value of the total collection.

Stuban said because the role is an elected position, the borough isn’t involved in training the tax collector.

“My concern is that a lot of the people who are applying don’t have any idea what they’re getting into,” Stuban said. “There are a lot of laws involved, and we’re learning a lot.”

Councilman Dave Trzcianka said his concern is that the new tax collector won’t be up to speed to file delinquent taxes.

Part of the tax collector’s job is also to file a list of delinquent taxes with the Beaver County Tax Claim bureau. The 2014 delinquent taxes are due to be filed by April 15, but Stuban said the borough has been advised they could ask for an extension.

On Wednesday, council will vote to authorize the solicitor to ask for an extension, if needed. Council also plans to authorize the borough’s office staff to compile a delinquent tax list, which Stuban said may involve working some overtime.

Secretary Elaine Rakovan said she is confident the borough could have the list of delinquents ready for the county with a one-month extension.

Stuban said the borough should prepare the delinquents rather than the newly-appointed tax collector because the office at least has an idea of what’s behind.

“We have the books, even though records were destroyed,” Stuban said. “I have been able to make heads or tails of the borough’s, but I haven’t been able to make heads or tails of the school district’s.”

Stuban said Baden currently has 140 delinquent taxes in 2014, equal to about $80,000 to $90,000, though some people have been making payments. About 80 percent are delinquent every year, he said, and the borough traditionally turns over about $50,000 in deliqnuent taxes to the county every year.

The tax collector doesn’t earn money on delinquent taxes. Baden pays the tax collector 2.5 percent on the money collected on taxes. Typically, Stuban said the tax collector will collect $850,000. The borough has already amassed $250,000 to $300,000, so the newly-appointed tax collector will get a lower percentage. The school district also pays a flat rate plus $5 per parcel based on 1,700 parcels, officials said.

Despite who is appointed, voters will choose a tax collector during a special election in the fall.

Sign up for our weekly newsletter. Like Ambridge Connection onFacebook and follow us on Twitter.

RSS Feed

RSS Feed